The Central Bank expressed support for large banks in their conflict with marketplaces over providing discounts to buyers through the subsidiary financial institutions of these online platforms. The Chairman of the Central Bank, Elvira Nabiullina, described this practice as unfair and sent a letter to Maxim Reshetnikov, head of the Ministry of Economy, with a proposal to prohibit online platforms from selling banking products on their resources. Marketplaces, however, state that banks are trying to limit competition.

Elvira Nabiullina believes that online platforms need to be prohibited from setting different prices depending on the chosen payment method. In addition, it is proposed to strengthen control over this process by regulatory authorities, in particular the Federal Antimonopoly Service.

The head of the Central Bank is confident in the need to introduce a ban on the sale of products of subsidiary banking structures through marketplaces. According to Elvira Nabiullina, such products have obvious uncompetitive advantages compared to the offers of other participants in the banking sector. Currently, on online platforms, you can purchase goods with cards from their subsidiary banks at lower prices than with other payment methods, which creates unequal conditions for other financial market participants.

The head of Sberbank, German Gref, first voiced the dissatisfaction of the banking sector with the discount practices of the online market, stating that online platforms underpaid 1.5 trillion rubles in taxes due to the discount system. At the same time, Elvira Nabiullina warned about a possible ban on marketplaces having subsidiary banks. Also, the dynamic development of online banking platforms creates high credit risks, not to mention their direct impact on retail and other sales channels, which lose to large players in the fight for the buyer.

In many countries, marketplaces are prohibited by law from having their own banks, but, fortunately for colleagues, our regulator does not yet require this, and we support its proposals.

Large banks note that they are not against discounts on marketplaces, the "outrage" is more related to their attachment to specific payment instruments, which "narrows the choice and can mislead people."

At the same time, the regional public organization "Moscow Society for the Protection of Consumers" appealed to the Prosecutor General's Office with a complaint about the systematic violation of legislation on the protection of consumer rights by a number of Russian banks.

The counter-claim has its own theses regarding banking monopolies. Thus, banks have created full-fledged trading platforms within their applications and are actively attracting audiences with the help of marketing programs and discounts. At the same time, buyers are forced to pay for goods and services with a card from only one bank.

In fair competition, the rules should be the same for everyone. You cannot first give business the green light for development, and then change the rules of the game only for one group of players, while maintaining privileges for another.

The Ministry of Economy believes that a systematic approach is needed to introduce restrictions on the provision of discounts. It is necessary to predict the possible consequences of the measures taken, assessing their impact on the economic activities of sellers, consumer behavior and the functioning of the platform economy as a whole.

Earlier www1.ru wrote that marketplaces in Russia want to ban investing in discounts.

Read also materials:

Now on home

Start of deliveries scheduled for 2027

Over 51,000 new motorcycles were sold in Russia in 2025

The car will take at least a year to assemble

The application's audience has reached 20 million users

The model will be included in the list of cars for taxis, price - from 2.25 million rubles

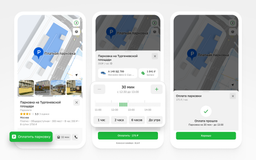

All parking lots of the "Administrator of the Moscow Parking Space" are connected to the service

The cars will be supplied to the Moscow Transport Service Directorate

Deliveries to India may begin in 2028

The technology provides automated search for all types of defects in power units

The plane flew 500 km, accelerating to 425 km/h

The plant stated that the information about the termination of purchases for models 6 and 8 is not true

Scientists are using the "Ekran-M" installation