From September 1, banks are required to check clients when withdrawing cash through ATMs for possible exposure to fraudsters. The law aimed at countering fraudsters came into force on June 1, but practical verification of ATM transactions began in September.

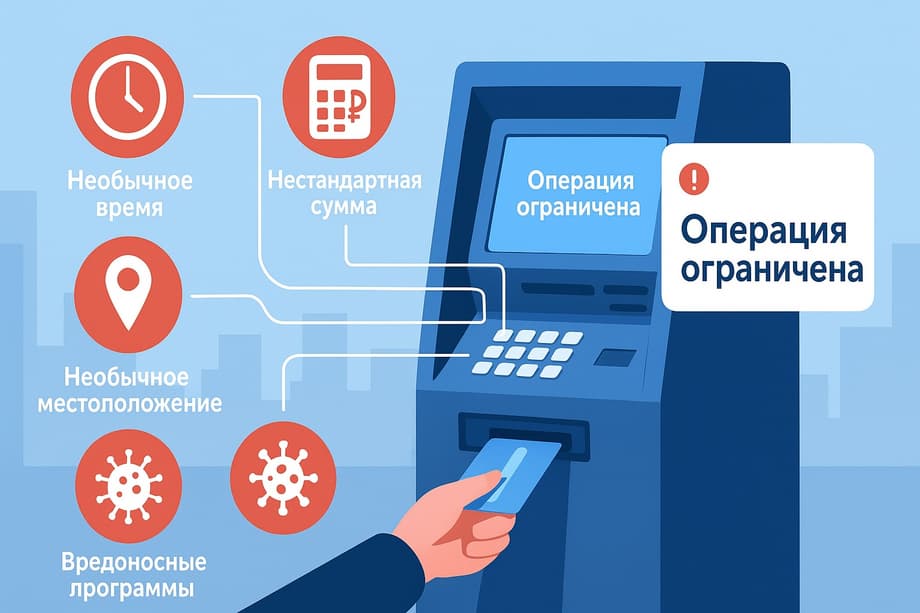

The Central Bank of the Russian Federation has identified nine signs of suspicious transactions. Among them: an unusual time of day, a non-standard amount, an unusual location of the ATM, the use of a new method of withdrawing funds, a sharp change in call and message activity, withdrawal of money shortly after a loan is issued or the limit is increased, a change of phone number, changes in device characteristics, and the presence of malicious programs. Separate criteria are provided for tokenized cards.

If the operation matches at least one sign, the bank notifies the client via SMS or push notification and sets a cash withdrawal limit for 48 hours - up to 50 thousand rubles per day. A larger amount can only be obtained at a bank branch.

Experts believe that the new measure is aimed at protecting customers and will not affect the total amount of cash withdrawals. Only a small number of transactions will be blocked, while funds will be issued upon contacting the bank.