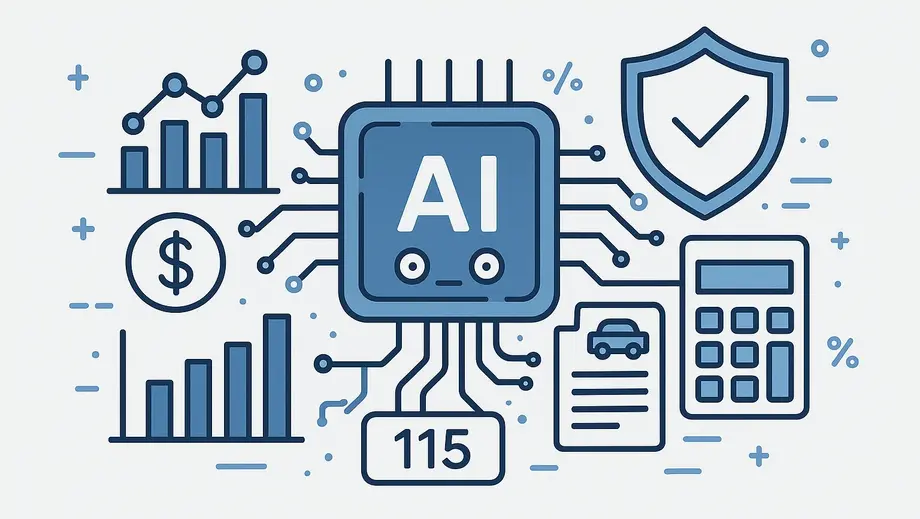

Rosgosstrakh IC has carried out a large-scale update of its AI models for calculating the cost of compulsory motor insurance policies. Now the system takes into account more than 115 factors, including driving experience, region of residence, accident statistics and even driver behavior on the road. This allows us to offer customers personalized rates that best match their level of risk.

According to Mariami Popova, Head of Modeling at Rosgosstrakh, the updated algorithms process huge amounts of data that cannot be analyzed manually.

We are constantly improving our big data analysis and modeling technologies, ensuring a thorough risk assessment based on information about concluded contracts and insurance events. AI technologies are especially in demand in compulsory motor insurance for individuals, since the market is large and highly competitive. Thanks to the risk assessment system, the company accurately assesses the cost of the product, and more than 4 million of the company's customers receive a price that corresponds to their level of risk. This helps to make insurance fairer for all road users.

The new models have already been integrated into all of the company's internal systems, including online calculators on the website and tools for insurance agents. In addition to calculating tariffs, Rosgosstrakh is actively implementing AI in claims processing, fraud prevention and customer service, increasing operational efficiency.

Read also materials on the topic:

Generative AI from Russian scientists can speed up DNA analysis