From September 1, a mandatory "cooling-off period" for consumer loans and borrowings is introduced in Russia. The decision was made by the Central Bank to reduce the risk of fraud.

The new rules apply to loans from 50 to 200 thousand rubles - the money will be available only four hours after signing the contract. If the amount exceeds 200 thousand rubles, the crediting will occur after 48 hours. The delay applies to loans issued online, in a bank office or in an MFO, as well as to credit cards when increasing the limit or loan amount.

During this time, the borrower can refuse the loan without financial consequences, interest is not charged. Exceptions are provided for loans up to 50 thousand rubles, as well as for mortgage, educational and car loans (when paying for a car to a legal entity).

Loans with guarantors or co-borrowers will be processed without delays, as well as refinancing, if it does not increase the amount of debt.

The delay does not apply to purchases on credit during a personal visit to a store or organization.

Read more on the topic:

More than 10 million Russians have set a self-ban on loans through "Gosuslugi"

Now on home

Start of deliveries scheduled for 2027

Over 51,000 new motorcycles were sold in Russia in 2025

The car will take at least a year to assemble

The application's audience has reached 20 million users

The model will be included in the list of cars for taxis, price - from 2.25 million rubles

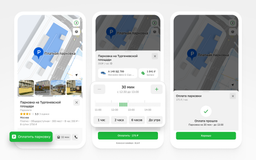

All parking lots of the "Administrator of the Moscow Parking Space" are connected to the service

The cars will be supplied to the Moscow Transport Service Directorate

Deliveries to India may begin in 2028

The technology provides automated search for all types of defects in power units

The plane flew 500 km, accelerating to 425 km/h

The plant stated that the information about the termination of purchases for models 6 and 8 is not true

Scientists are using the "Ekran-M" installation