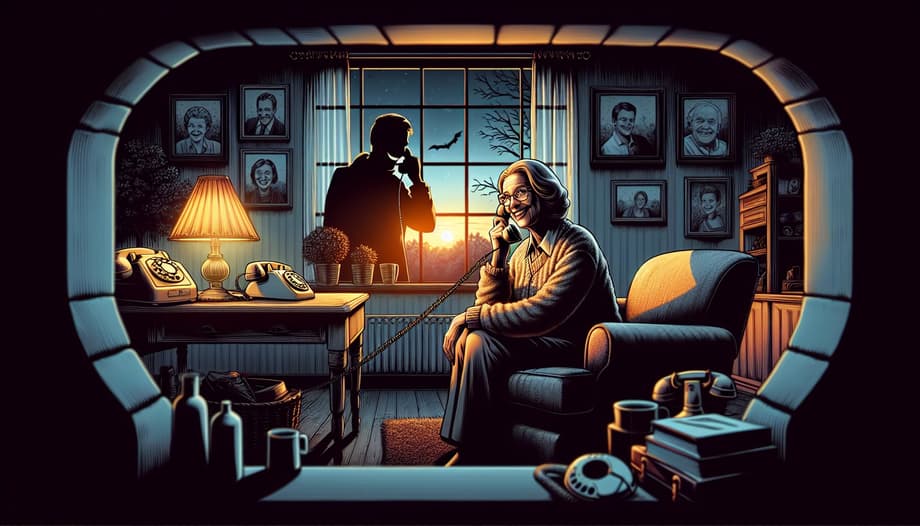

Financial institutions are launching "second pair of hands" services to protect customers from fraud. These services allow you to appoint a trusted person, such as a relative, who can reject suspicious transactions. We tell you more about what is happening.

In December, T-Bank launched a service that allows you to appoint a trusted person who can check and reject certain transactions if there are suspicions of fraud. The service covers transfers to unfamiliar details, loan applications and early termination of deposits.

Only those transactions that meet certain risk conditions will be sent for additional verification - about 2% of all customer actions. The trusted person will receive an SMS or push notification and will have 24 hours to confirm the transaction, otherwise it will be rejected.

This service is especially important for elderly people who are more vulnerable to the social engineering methods of fraudsters. It will also help protect teenagers from deception related to pseudo-work and prevent cases when they become "drops" - they issue cards for further resale to attackers.

According to T-Bank's estimates, the service will prevent losses of more than 1.5 billion rubles annually.

Sber also has a similar service, but without the right for a relative to reject transactions. It allows you to share information about expenses and income on the card with a loved one. When the service is connected, the selected person will receive notifications about transactions on the card, which will help to respond to suspicious write-offs in time. However, unlike T-Bank, Sber has a paid option - according to the bank's website, it costs 99 rubles for each person who will receive notifications.

What does the Central Bank think?

The Bank of Russia several years ago recommended that credit institutions introduce a "second pair of hands" service to protect elderly people and people with disabilities from fraudsters. It allows you to appoint an assistant who can reject suspicious transfers and receive information about attempts by the ward to withdraw large sums of cash. The assistant should help to understand the situation.

The Central Bank noted that so far only a small number of banks have responded to the recommendations and introduced a notification service for elderly clients. These people often become victims of fraudsters, following their instructions and not informing their relatives about their actions. As a result, they lose money.

Based on the recommendations of the Central Bank, a bill was developed on the introduction of the "second pair of hands" service, which has already been adopted in the first reading. According to it, systemically important banks will be required to offer such a service to their clients.

Read more on the topic:

A new fraud scheme has appeared in Russia

A database of biometric data of fraudsters was proposed to be created in Russia

Attackers have learned how to steal money from Russians through "Gosuslugi"