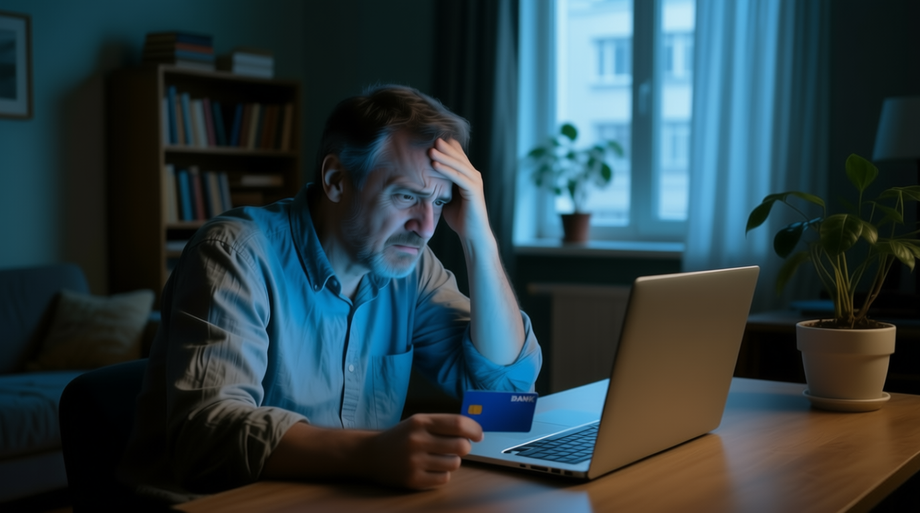

The Central Bank has recorded an increase in complaints about the blocking of bank cards and transfers. The regulator is taking measures to protect bona fide clients. This was stated by the head of the Central Bank, Elvira Nabiullina.

We have seen a surge in complaints about unjustified blocking of citizens' funds. Indeed, this worries us. Here it is very important to take all measures to ensure that absolutely bona fide people's funds are not blocked.

According to her, banks have the right to block clients' accounts if they suspect fraud, money laundering, or violation of tax laws.

If we talk about measures against fraud, the bank is obliged to block the client's card when it receives data about this client from the Central Bank database, and this information is entered according to law enforcement agencies.

To unblock an account, you need to contact the bank, since all such operations can be carried out only with a personal visit. There are various mechanisms for appealing blockages, but they also require a personal visit to the financial institution.

Experts emphasize that banks' suspicions regarding clients sometimes turn out to be unfounded, and the number of such cases is growing. Bona fide clients spend time and nerves communicating with technical support and visiting offices to regain the right to manage their money.

Analysis of reviews shows that the risk of blocking transfers exists in any bank, regardless of its size. The main reasons for blockages are related to compliance with laws on countering the legalization of proceeds from crime and the financing of terrorism, as well as with the requirements for the national payment system.

Banks are required to develop their own anti-fraud systems. Depending on their settings, transfers may be blocked more or less frequently. Bank employees may request documents to verify the legality of transactions.

If information about the recipient is contained in the database of fraudulent transactions, the transfer will be suspended, even if the client insists on its execution. The bank will notify the client of the reason for the blockage and the suspension period.

Financial Commissioner Svetlana Maksimova said that in case of disputes, clients can contact the financial ombudsman or the court. It is important to remember that the bank is obliged to carry out anti-fraud measures even when transferring to accounts in other banks.

If you encounter a blockage, you should try contacting the Financial Ombudsman Service, which allows you to protect your rights without additional costs for lawyers, added Maksimova.